| RECORD DATE Only shareholders of record as of the close of business on April 1, 2021, will be entitled to notice of, and to vote at, the Annual Meeting. VOTING Each share of common stock is entitled to one vote on each of the items to be voted on at the Annual Meeting.It is important that your shares be represented at the Annual Meeting regardless of the size of your holdings.A Proxy Statement, proxy card and self-addressed envelope are enclosed. Return the proxy card promptly in the envelope provided, which requires no postage if mailed in the United States. You can also vote by telephone or by the Internet by following the instructions provided on the proxy card. Whether or not you plan to attend the Annual Meeting in person, please vote by one of these three methods. If you are the record holder of your shares and you attend the meeting, you may withdraw your proxy and vote in person, if you so choose. | By Order of the Board of Directors, | | /s/ Robert Savage | Robert Savage

|

Lori B. Marino Chairman of the Board of DirectorsCorporate Secretary

|

55 West 46th StreetNOTICE

Suite 2204of the 2021

Annual Meeting

of Shareholders

New York, New York 10036

April 30, 2019YOUR VOTE IS VERY IMPORTANT

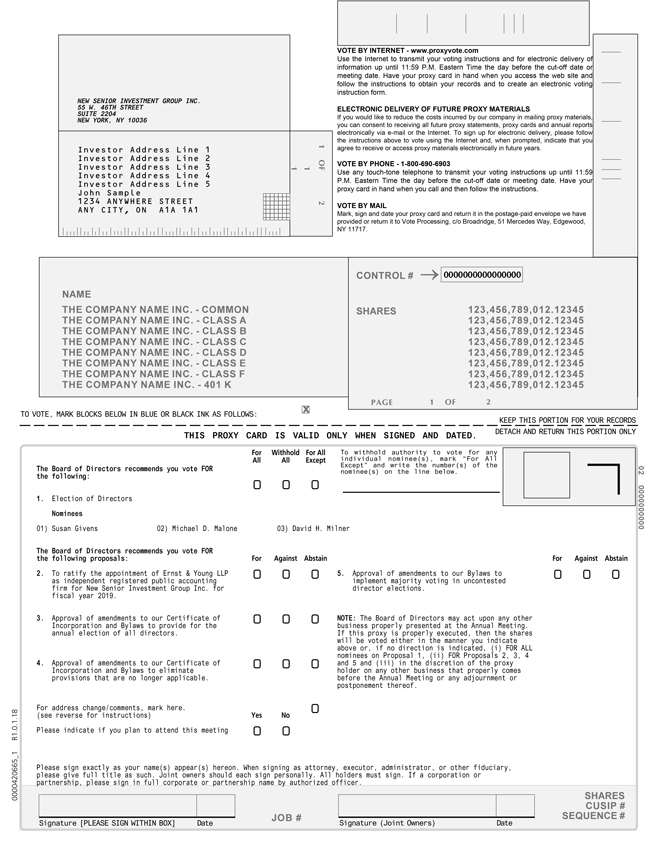

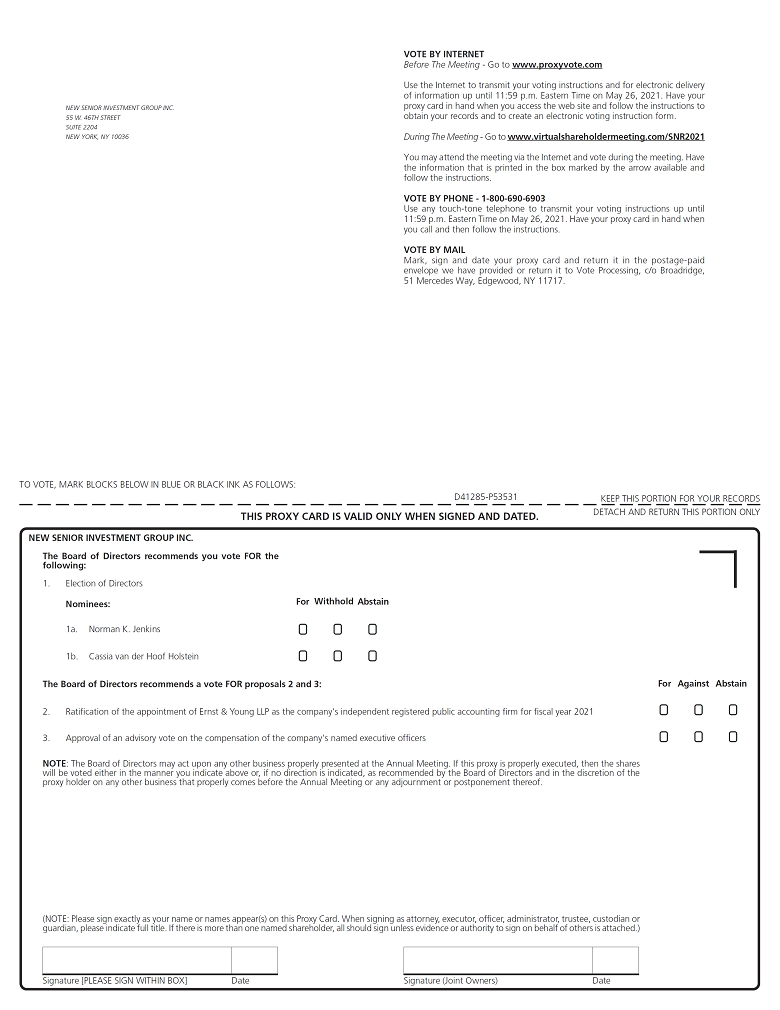

If you do not expect to attend the virtual Annual Meeting, we urge you to vote by telephone or Internet as described below, or, if you received your materials by mail, by completing, dating, and signing the proxy card/voting instruction form, and returning it in the accompanying envelope. You may revoke your proxy or instructions at any time before your shares are voted by following the procedures described in “Voting Information” beginning on page 49. PROXY VOTING METHODS Even if you plan to attend the virtual Annual Meeting, please vote right away by using one of the following advance voting methods. Make sure to have the proxy card/voting instruction form or Notice of Internet Availability in hand and follow the instructions. You can vote in advance in one of three ways:  | VIA THE INTERNET

Visit 24/7: www.proxyvote.com | | | |  | BY TELEPHONE

Dial toll-free 24/7: 1-800-690-6903 | | |  | BY MAIL

Complete, sign, date and return the enclosed proxy card in the envelope provided. | | |  | Scan the QR code to view digital versions of New Senior’s Proxy Statement and 2020 Annual Report. |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE STOCKHOLDERSHAREHOLDER MEETING TO BE HELD ON June 12, 2019:MAY 27, 2021:

The Notice of Annual Meeting, Proxy Statementproxy statement and the Annual Report on Form10-K

are available on the Investor Relations section of our website at

www.newseniorinv.com. |

TABLE OF CONTENTSTable of Contents

i

APPENDIX A

NEW SENIOR INVESTMENT GROUP INC. • 2021 Proxy Statement | 3 | | A-1 |

ii

NEW SENIOR INVESTMENT GROUP INC.

55 West 46th Street, Suite 2204

New York, New York 10036

PROXY STATEMENT For the 20192021 Annual Meeting of StockholdersShareholders to Bebe Held on May 27, 2021 June 12, 2019

Proxy Statement Executive Summary This Proxy Statementproxy statement (the “Proxy Statement”) and the accompanying proxy card and notice of annual meeting are provided in connection with the solicitation of proxies by and on behalf of the Board of Directors of New Senior Investment Group Inc., a Delaware corporation, for use at the Annual Meeting to be held on June 12, 2019May 27, 2021 and any adjournments or postponements thereof. “We,” “our,” “us,” “the Company” and “New Senior” each refersrefer to New Senior Investment Group Inc. The mailing address of our executive office is 55 West 46th46 Street, Suite 2204, New York, New York 10036. This Proxy Statement, the accompanying proxy card and the notice of annual meeting are first being mailed to holders of our common stock, par value $0.01 per share (the “Common Stock”), on or about May 3, 2019.April 12, 2021. At the date hereof, management has no knowledge of any business that will be presented for consideration at the Annual Meeting and which would be required to be set forth in this Proxy Statement or the related proxy card other than the matters set forth in the Notice of Annual Meeting of Stockholders.Shareholders. If any other matter is properly presented at the Annual Meeting for consideration, it is intended that the persons named in the enclosed form of proxy and acting thereunder will vote in accordance with their best judgment on such matter. Matters to be consideredConsidered at the Annual Meeting At the Annual Meeting, stockholdersshareholders of the Company’s Common Stock will vote upon: | Proposal | Board

Recommendation | Page | | 1 | Election of Directors | FOR | 20 | | | | each Director Nominee | | | 2 | Ratification of the Appointment of Ernst & Young LLP as Independent Registered Public Accounting Firm for Fiscal Year 2021 | FOR | 25 | | 3 | Advisory Vote on 2020 Executive Compensation | FOR | 27 |

How to Vote  | |  | |  | |  | | | | | | | | | VIA THE INTERNET | | BY TELEPHONE | | BY MAIL | | Scan the QR code to view digital | | Visit 24/7 | | Dial toll-free 24/7 | | Complete, sign, date and return the | | versions of New Senior’s Proxy | | www.proxyvote.com | | 1-800-690-6903 | | enclosed proxy card in the envelope | | Statement and 2020 Annual Report | | | | | provided | | |

| NEW SENIOR INVESTMENT GROUP INC. • 2021 Proxy Statement | 4 |

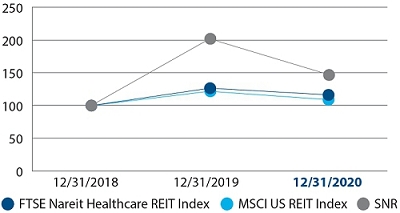

Fiscal 2020 Highlights Following a transformational year for New Senior in 2019 as we internalized our management effective January 1, 2019 (the “Internalization”), fiscal 2020 started out strong. However, beginning in February our business began to face significant challenges with the onset of the COVID-19 pandemic. While the pandemic has severely impacted the entire world, at-risk populations, including seniors in the communities we serve, have been disproportionately impacted by the effects of COVID-19. The health and safety of our residents and our operators’ associates around the country was – and remains – our top priority. The pandemic led federal, state and local governments and public health authorities to impose measures intended to control the spread of COVID-19, including restrictions on freedom of movement and business operations such as travel bans, border closings, business closures, quarantines and shelter-in-place orders. As the owner of a portfolio of independent senior living properties, our operators had to implement several measures to ensure the health and safety of residents and employees, including restrictions on move-ins, restrictions on non-essential visitors, restrictions on communal dining and activities, enhanced cleaning protocols and requirements to wear personal protective equipment. As a result of these actions, we had fewer move-ins, resulting in significant occupancy declines, and higher expenses as our operators worked to limit the spread of the virus. While necessary, these actions had a significant impact on our operational and financial performance in 2020, and these actions and the uncertainty caused by the pandemic resulted in increased volatility in our stock price performance throughout the year. While the pandemic had a significant impact on our business, we saw features unique to our independent living properties that allowed our operators to adjust protocols within our communities and effectively manage the spread of the virus while also reducing expenses in response to lower occupancy levels. As a result, our incidence rate of COVID-19 cases throughout the year remained relatively low versus reported results in the senior housing industry, and our portfolio has experienced lower occupancy and NOI declines than the broader industry. In addition, strategic initiatives completed early in 2020 positioned us well prior to the onset of COVID-19. These actions, together with strong balance sheet management, enabled us to achieve solid AFFO(1) per share results of $0.71, which was at the high end of the original guidance that we provided to investors in February 2020 prior to the onset of COVID-19, and was also at the high end of the guidance that we provided to investors in August 2020 in connection with the release of our second quarter earnings results. We executed significant initiatives within our capital structure and portfolio, as well as at the corporate level, to mitigate the pandemic’s overall impact on our results: | Corporate | • Established principles to guide actions during COVID-19 pandemic ○ Focus on safety and health of residents and property-level associates ○ Remain a proposalstrong partner to elect three Class II directorsour operators and other business relationships – Protect our financial health • Focused on transparency with frequent communications to serve untilstakeholders ○ Provided frequent updates on COVID-19 ○ Provided revised expectations for 2020 financial performance throughout the 2022 annual meetingyear • Identified and achieved G&A reductions to help offset portfolio NOI declines • Continued governance improvements including appointment of stockholdersnew independent director | | | Portfolio | • Completed sale of 28-asset AL/MC portfolio in February 2020 ○ Simplified portfolio & improved free cash flow • Focused asset management – worked closely with our operators throughout the pandemic ○ Made difficult decisions early in the crisis including restricting access to properties ○ Collaborated and until their successors are electedadvised on protocol changes throughout the pandemic • Worked with operators to identify opportunities to reduce property level operating costs ○ Flexible operating and duly qualified;staffing models allowed for efficient cost controls ○ Capitalized on operational expense savings opportunities improving results | | | Capital Structure & Liquidity | • Significantly improved balance sheet through portfolio transaction executed in February 2020 ○ Repaid ~$360 million of debt ○ Completed ~$400 million of refinancing activity, resulting in lower debt costs and an extension of debt maturities by two years • Closely monitored interest rate environment throughout pandemic and opportunistically executed interest rate swap, de-risking future borrowing costs • Managed liquidity to ensure Company was well-positioned given uncertainty ○ Reduced non-essential capital expenditures enabling liquidity preservation ○ Reduced dividend by 50% to preserve liquidity; still returned $26.8 million to shareholders (6.3% dividend yield for 2020) |

| (1) | (ii) | AFFO represents a proposalnon-GAAP financial measure. For a reconciliation of each such measure to approve the appointment of Ernst & Young LLP as independent registered public accounting firm for the Company for fiscal year 2019; most directly comparable measure calculated in accordance with GAAP, refer to Appendix A to this Proxy Statement. |

| NEW SENIOR INVESTMENT GROUP INC. • 2021 Proxy Statement | (iii)5 |

In summary, despite an extremely challenging year, we were pleased with how our business performed in the face of the global pandemic in 2020. We believe that our portfolio continues to benefit from our independent living model and a more flexible expense structure. We were able to offset occupancy losses at our properties throughout the year with property expense reductions and interest savings. We worked tirelessly with our operators to respond swiftly at the outset of the pandemic, including making difficult decisions early on to restrict access to our properties to protect residents and staff. We believe that these actions, together with financial efficiencies driven by our independent living model, helped us to achieve strong AFFO results for 2020. Our stock price at the close of the year partially recovered to $5.18, which we believe reflects an understanding by investors of our 2020 results and positioning in the market going forward. Corporate Governance Highlights We are committed to strong governance practices that are intended to protect the long-term interests of our shareholders and establish strong accountability. The section entitled “Corporate Governance and Related Matters” describes our governance framework, and the progress we made in this area in the last year. | What We Do |  | Independent Chair of the Board | |  | Proxy Access Right Added in Early 2020 |  | Board of Directors Characterized by Leadership, Experience, Diversity and Independence | |  | Resignation Policy in Guidelines for Directors Who Don’t Receive Majority Support in Uncontested Elections Added in Early 2020 |  | Annual Board and Committee Self-Assessments | |  | Meaningful Stock Ownership Guidelines |  | Commitment to amend our amendedAligning Director Skillset With Corporate Strategy | |  | Formal Director Orientation and restated certificateContinuing Education |  | No Shareholder Rights Plan (Poison Pill) | |  | Regular Executive Sessions of incorporation (the “Certificate of Incorporation”)Board and our amended and restated bylaws (the “Bylaws”)Committees | | | |  | Proactive Shareholder Engagement |

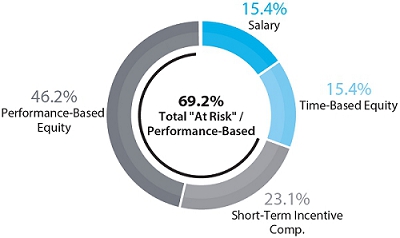

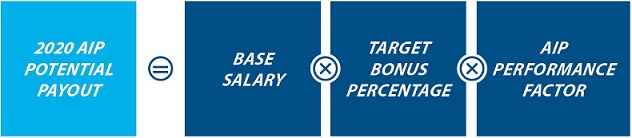

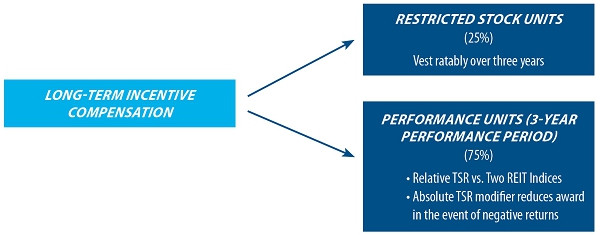

Executive Compensation Highlights The Compensation Committee of the Board of Directors has established a set of compensation policies and practices that it believes are in the best, long-term interests of our shareholders now that we are internally managed. The onset of the COVID-19 pandemic required the Compensation Committee to assess the Company’s original goals, adopted just prior to the onset of the pandemic, and establish a framework for 2020 that made sense for New Senior given its business, its actual financial performance and the contributions and achievements of the management team. There is extensive discussion throughout “Compensation Discussion and Analysis” relating to our executive compensation practices and the compensation decisions made with respect to 2020. | NEW SENIOR INVESTMENT GROUP INC. • 2021 Proxy Statement | 6 |

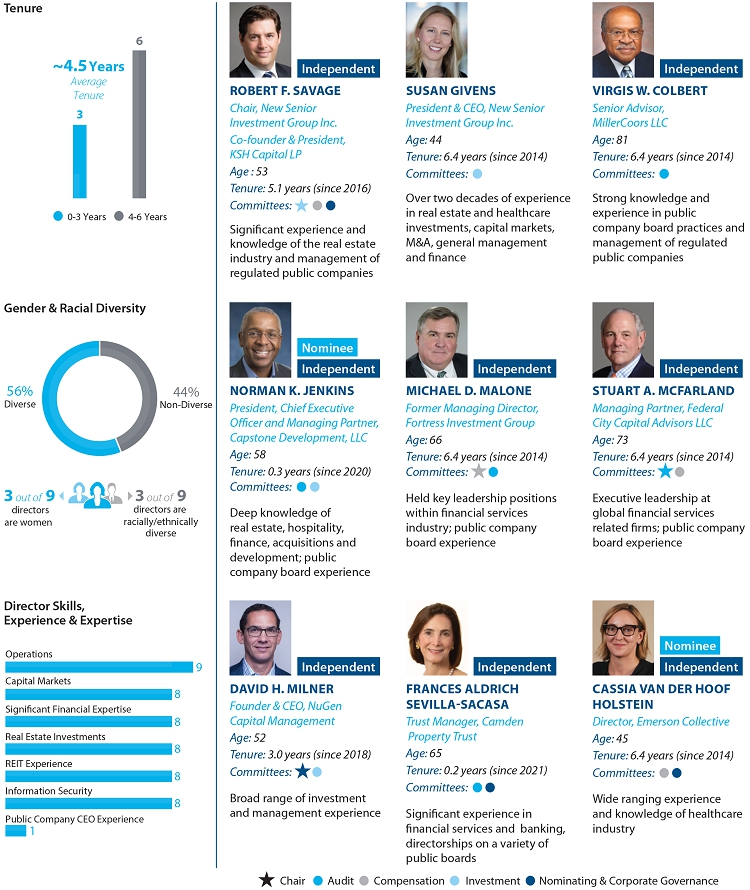

Snapshot of Our Directors, Including the 2021 Director Nominees Experienced and Diverse Board of Directors

| NEW SENIOR INVESTMENT GROUP INC. • 2021 Proxy Statement | 7 |

Corporate Governance and Related Matters Statement on Corporate Governance We strive to maintain the highest standards of corporate governance and ethical conduct. Promoting full compliance with the laws, rules and regulations that govern our business and reporting results with accuracy and transparency are critical to those efforts. We monitor developments in the area of corporate governance, encourage and consider feedback from our shareholders, and review our processes and procedures in light of this input. We also review federal and state laws affecting corporate governance, as well as rules and requirements of the New York Stock Exchange (the “NYSE”). We implement corporate governance practices that we believe are in the best interests of the Company and its shareholders. We also understand that corporate governance practices evolve over time, and we seek to maintain practices which provide the right framework for our operations, which are of value to our shareholders and which positively aid in the governance of the Company. The following sections provide an overview of New Senior’s corporate governance structure and processes, including the independence and other criteria we use in selecting director nominees, our leadership structure, and certain responsibilities and activities of the Board of Directors and its committees. New Senior’s key governance documents, including our Corporate Governance Guidelines (the “Guidelines”), the charters for the Audit, Compensation and Nominating and Corporate Governance Committees, our Code of Business Conduct and Ethics and the Code of Ethics for Senior Officers, which applies to our Chief Executive Officer, Chief Financial Officer and Chief Accounting Officer (or persons performing similar functions in the absence of such titles), are available on the Investor Relations page of our website at www.newseniorinv.com. Within this Proxy Statement we have included our website address only as an inactive textual reference and do not intend it to be an active link to our website. New Senior’s website is not incorporated into or a part of this Proxy Statement. Shareholders may also obtain copies of these documents free of charge by sending a written request to New Senior at 55 West 46 Street, Suite 2204, New York, New York 10036, Attention: Investor Relations. Governance Overview We strive to maintain the highest standards of corporate governance. Shortly following the Internalization of the Company’s operations at the start of 2019 (see “—Certain Relationships and Related Party Transactions” for a discussion of the Internalization), the Board, with the assistance of management, began a review of the policies and practices of the Company with a view towards modernizing the Company’s corporate governance practices. As a result of this comprehensive review, which included the feedback received from investors, various practices were considered and changes were implemented to the Company’s overall governance structure. These changes were described in detail in the proxy statement related to the 2020 Annual Meeting of Shareholders, and included changes in the following areas: | Board Structure | Director Compensation | Board & Company Policies & Procedures | | Bylaws | Board Self-Assessment | Executive Compensation Practices |

| Proposals in 2020 & 2019 Proxy Statement recommending: |

• Declassification of the Board and annual election of all directors;directors |

| (iv) | a proposal to amend our Certificate• Implementation of Incorporation and Bylaws to eliminate certain provisions that are no longer applicable;

|

| (v) | a proposal to amend our Bylaws to implement a majority voting standard for uncontested elections of directors;directors

| • Elimination of supermajority voting provisions in Certificate of Incorporation and Bylaws |

| (vi) | any other business that may properly come before the annual meeting of stockholders or any adjournment of the annual meeting.

|

GENERAL INFORMATION ABOUT VOTING

SolicitationAlthough we have enhanced our governance in many ways, we have not been successful in obtaining shareholder approval on all the governance items that we have recommended to shareholders for adoption. As indicated in the table above, for the past two years, we have recommended amending our Certificate of Proxies

Incorporation and our Bylaws to implement changes such as instituting the annual election of directors, who would get elected through a majority voting standard in uncontested elections. In addition, last year the Board recommended to shareholders that we eliminate various supermajority voting provisions throughout the Certificate of Incorporation and Bylaws. The enclosed proxy is solicited byBoard, through its Nominating and on behalf of our Board of Directors. The expense of preparing, printing and mailingCorporate Governance Committee, discussed whether to again include in this Proxy Statement and the proxies solicited hereby will be borne bythree proposals outlined above. Following two years of these proposals failing to garner the Company. In addition tosupport of anywhere near the use of the mail, proxies may be solicited by officers and directors, without additional remuneration, by personal interview, telephone or otherwise. The Company will also request brokerage firms, nominees, custodians and fiduciaries to forward proxy materials to the beneficial owners of shares held of record as of the close of business on April 15, 2019, and will provide reimbursement for the cost of forwarding the material. Stockholders Entitled to Vote

As of April 15, 2019, there were outstanding and entitled to vote 82,209,844 shares of our Common Stock. Each share of our Common Stock entitles the holder to one vote. Stockholders of record at the close of business on April 15, 2019 are entitled to vote at the Annual Meeting or any adjournment or postponement thereof.

Stockholder of Record. If your shares are registered directly in your name with the Company’s transfer agent, American Stock Transfer & Trust Company LLC, you are considered the stockholder of record with respect to those shares, and these proxy materials were sent directly to you by the Company.

Street Name Holders. If your shares are held in an account at a brokerage firm, bank, broker-dealer or other similar organization, then you are the beneficial owner of shares held in “street name,” and these proxy materials will be or have been forwarded to you by your bank or broker. The bank or broker holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to instruct your bank or broker on how to vote the shares held in your account. If you wish to attend the Annual Meeting, you will need to obtain a “legal proxy” from your bank or broker.

Required Vote

A quorum will be present if the holders of a majority80% of the outstanding shares entitled to vote are present, in person or by proxy, atrequired for approval, we have removed the Annual Meeting. If you have returned a valid proxy or if you hold your shares in your own name as holder of record and attendproposals from the Annual Meeting in person, your shares will be counted as present for the purpose of determining whether there is a quorum. Votes to “withhold,” abstentions and broker“non-votes” (as described below) will be treated as shares that are present and entitled to vote for purposes of determining the presence of a quorum.

If a quorum is not present, the Annual Meeting may be adjournedballot this year. This decision was made by the chairmanBoard after garnering shareholder feedback on this and other governance issues. Management also sought the input of the meeting or by the voteInstitutional Shareholder Services when considering this question.

Approval and adoption of a majorityall three of those proposal required the shares represented at the Annual Meeting until a quorum has been obtained. For the election of the nominees to our Board of Directors, the affirmative vote by holders of a plurality of shares present, in person or by proxy, and entitled to vote on the election of directors is sufficient to elect each nominee. The approval of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2019 requires the affirmative vote of holders of a majority of the shares present, in person or by proxy, and entitled to vote on such proposal. The affirmative vote of at least 80% of the voting power of our issued and outstanding shares entitled to vote thereon will be required to approvevote. Abstentions and broker non-votes have the proposals to amend (i) our Certificate of Incorporation and Bylaws to provide for the annual election of all directors, (ii) our Certificate of Incorporation and Bylaws to eliminate certain provisions that are no longer applicable and (iii) our Bylaws to implement majority voting for uncontested elections of directors.

Brokernon-votes are instances where a broker holding shares of record for a beneficial owner does not vote the shares because it has not received voting instructions from the beneficial owner and therefore is precluded by the rules of the New York Stock Exchange (“NYSE”) from voting on a particular matter. Under NYSE rules, when a broker holding shares in “street name” does not receive voting instructions from a beneficial owner, the broker has discretionary authority to vote on certain routine matters but is prohibited from voting onnon-routine matters.same effect as votes against these proposals. Brokers who do not receive instructions are not entitledpermitted to vote on these three proposals, because they are considered “non-routine” matters under New York Stock Exchange (“NYSE”) rules. Therefore, individuals who hold shares in an account at a brokerage firm,

| NEW SENIOR INVESTMENT GROUP INC. • 2021 Proxy Statement | 8 |

bank, broker-dealer or other similar organization (retail holders or street name holders), would have to instruct their brokers to vote on these matters. The high percentage of “retail” holders of New Senior’s stock, which is estimated at over 30% of our outstanding shares, together with the typically low voting participation of retail holders, make it extremely unlikely that sufficient numbers of shares will ever be voted to overcome this very substantial voting percentage requirement. Therefore, the Board determined not to include these proposals on this year’s Proxy Statement to save printing and other costs associated with continuing to put these proposals to a shareholder vote. The Board may in the future make a different determination and we expect to revisit this again each year, particularly if we see shifts in our shareholder base to more institutional ownership that we believe would increase the likelihood of our obtaining the approval of the requisite 80% of the outstanding shares. Corporate Governance Guidelines The Board of Directors has adopted the Guidelines, which govern the operations of the Board and its committees and guide the Board and New Senior’s leadership team in the execution of their responsibilities. The Nominating and Corporate Governance Committee is responsible for overseeing the Guidelines. The Nominating and Corporate Governance Committee reviews the Guidelines at least annually and makes recommendations to the Board for updates in response to changing regulatory requirements, issues raised by shareholders or other stakeholders, changing regulatory requirements or otherwise as circumstances warrant. The Board may amend, waive, suspend, or repeal any of the Guidelines at any time, with or without public notice, as it determines necessary or appropriate in the exercise of the Board’s judgment or fiduciary duties. The Guidelines are available on the Investor Relations page of our website at www.newseniorinv.com. The Guidelines are reviewed annually and the last amendments were made in February 2020, which among other things instituted limits on outside board service by our directors and implemented a resignation policy for directors who do not receive a majority of the votes of the shareholders in their election. The current Guidelines include the following items concerning the Board: | • | no director may stand for re-election after he or she has reached the age of 75; | | • | directors are expected to spend the time and effort reasonably necessary to properly discharge their responsibilities, including regularly attending Board and Committee meetings and reviewing meeting materials in advance of meetings; | | • | directors are limited to service on four public company boards (other than the New Senior Board). If the director serves as an executive officer of a public company, the director is limited to service on two public company boards (including the New Senior board) other than service on his or her own board; | | • | the Board, acting through the Compensation Committee and after soliciting the views of the independent directors, evaluates the performance of the Chief Executive Officer at least annually; | | • | the Board has responsibility for planning for the succession of the Chief Executive Officer; and | | • | the Board maintains a process whereby the Board and its committees are subject to annual self-assessment. |

Director Resignation Policy Under the director resignation policy that was adopted in 2020, a director in an uncontested election from whom a greater number of votes are “withheld” than cast in favor of his or her election will be required to promptly submit his or her resignation for consideration by the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee will then consider all relevant facts and circumstances and make a recommendation to the Board as to whether the resignation should be accepted. The Board will then, taking into consideration the recommendation of the Nominating and Corporate Governance Committee and any other factors it deems relevant, determine whether to accept or reject the resignation no later than 90 days after the conclusion of the annual meeting. A director who has tendered his or her resignation pursuant to this policy will not participate in the consideration or determination of whether to accept such resignation. Promptly following the Board’s decision, the Company will disclose the decision and provide an explanation. This director resignation policy is in effect for the election of directors or the proposals to amend (i) our Certificate of Incorporation and Bylaws to provide for the annual election of all directors, (ii) our Certificate of Incorporation and Bylaws to eliminate certain provisions that are no longer applicable or (iii) our Bylaws to implement majority voting for uncontested director elections. However, brokers are entitled to vote on the ratification of the appointment of the independent registered public accounting firm. A vote “withheld” from a director nominee or a brokernon-vote on a director nominee will have no effect on the outcome of the election. For the ratification of the appointment of the independent registered public accounting firm, abstentions will have the same effect as votes “against” and brokernon-votes will have no effect. Both abstentions and brokernon-votes will have the same effect as votes “against” the proposals to amend (i) our Certificate of Incorporation and Bylaws to provide for the annual election of all directors, (ii) our Certificate of Incorporation and Bylaws to eliminate certain provisions that are no longer applicable and (iii) our Bylaws to implement majority voting for uncontested elections of directors.

If the enclosed proxy card is properly executed and returned to us in time to be voted at the Annual Meeting,Meeting.

Directors’ Qualification and Selection Process The Board strives to maintain an appropriate balance of tenure, turnover, diversity and skills among directors. The Board believes that there are significant benefits from the valuable experience and familiarity with the Company and its people and processes that longer-tenured directors bring, as well as significant benefits from the fresh perspective and ideas brought by new directors. The Nominating and Corporate Governance Committee leads the process in identifying, recruiting and, if appropriate, interviewing candidates to fill positions on the Board. The Nominating and Corporate Governance Committee takes into account a variety of factors in fulfilling its responsibility to identify and recommend to the Board of Directors qualified candidates for membership on the Board. Directors of the Company must be persons of integrity, with significant accomplishments and recognized business stature. | NEW SENIOR INVESTMENT GROUP INC. • 2021 Proxy Statement | 9 |

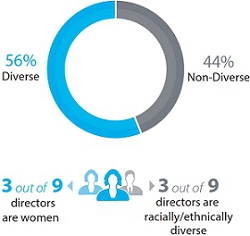

The Nominating and Corporate Governance Committee, as required by the Guidelines, will select nominees for director based on a variety of factors including experience, knowledge, skills, expertise, integrity, diversity (including diversity of origin, background, experience, and thought), ability to make independent analytical inquiries, understanding of the Company’s business environment and willingness to devote adequate time and effort to Board responsibilities. In addition, the Nominating and Corporate Governance Committee looks for individuals who demonstrate business judgment, dedication, freedom from potential conflicts of interest and such other relevant factors that the Committee considers appropriate to enhance the board’s ability to manage and direct the affairs and business of the Company, including individuals who enhance the ability of committees of the Board to fulfill their duties and to satisfy requirements imposed by applicable law, regulation or NYSE listing requirements. The Nominating and Corporate Governance Committee’s top priority in considering director nominations is ensuring that the Board is composed of directors who bring independence, diverse viewpoints and perspectives, exhibit a variety of skills, professional experience and backgrounds, and the ability to effectively represent the long-term interests of our shareholders. We do not have a formal policy with regard to the consideration of diversity in identifying director-nominees, but the Nominating and Corporate Governance Committee strives to nominate diverse candidates for membership on the Board when it has a vacancy to fill and includes diversity as a specific factor when conducting searches for candidates. Over the past six months, two new directors have joined the Board – Frances Aldrich Sevilla-Sacasa and Norman K. Jenkins. Both are seasoned executives who bring a wealth of directly relevant experiences to the Board. In addition, both bring extensive experience from serving on other public company boards, which adds new perspectives and continues to ensure comprehensive and effective oversight of the Company and support of our strategic goals. The Nominating and Corporate Governance Committee assesses its achievement of diversity through the review of the Board’s composition as part of the Board’s annual self-assessment process and at other times, such as when the Board is recruiting new candidates. The Board is currently comprised of nine directors, three of whom are female, and two of whom are African American. The directors come from diverse professional backgrounds and industries, including real estate, financial and hospitality. In “Proposal No. 1 –Election of Directors,” we provide an overview of the background of each of our directors, including an overview of their background, principal occupation, age, skills and qualifications . Gender, Racial & Ethnic Diversity

The Nominating and Corporate Governance Committee may identify director candidates through a variety of sources including through independent search firms, personal references, business contacts and our shareholders. Shareholders who wish to recommend candidates may contact the Nominating and Corporate Governance Committee in the manner described in “Communication with the Board of Directors.” Shareholder nominations must be made according to the procedures required by our Bylaws and described in this Proxy Statement under the heading “Information about Proxy Statement & Voting.” Shareholder-recommended candidates and shareholder nominees whose nominations comply with these procedures and nominees who meet the criteria referred to above will be votedevaluated by the Nominating and Corporate Governance Committee in the same manner as specifiedother nominees. Biographical information for each candidate for election as a director is evaluated and candidates for election participate in interviews with existing Board members and management. Nominees must meet the requirements of the Company’s Bylaws and the Guidelines. Board and Committee Evaluation Process We recognize the critical role that Board and committee evaluations play in ensuring the effective functioning of our Board. Our Board annually evaluates the performance of the Board and its committees. In 2020 this evaluation took the form of a formal self-assessment with respect to the operations and performance of the Board and each of its committees. As part of this process, directors completed questionnaires on various topics related to Board composition, structure, effectiveness and responsibilities, as well as the overall mix of director skills, experience and backgrounds. The Nominating and Corporate Governance Committee and the full Board each discuss the questionnaire responses. As set forth in the Guidelines and its charter, the Nominating and Corporate Governance Committee oversaw the Board and committee evaluation process. The results of the self-assessment process for 2020 (conducted in early 2021) confirmed the Board’s belief that the Board and its committees are currently operating effectively. The Nominating and Corporate Governance Committee has responsibility for reviewing the process periodically and considering whether changes are warranted to the evaluation process. | NEW SENIOR INVESTMENT GROUP INC. • 2021 Proxy Statement | 10 |

Director Orientation and Continuing Education As part of New Senior’s director orientation program, new directors participate in one-on-one introductory meetings with members of New Senior’s leadership team. This director orientation familiarizes the directors with our business and strategic plans, significant financial, accounting and risk management issues, human resources matters, our compliance programs and other controls, policies and procedures. The orientation also addresses Board procedures, our Guidelines and our Board committee charters. Finally, it provides directors with the opportunity to meet with the key members of senior management. Over the past year we have onboarded two new directors, Mr. Jenkins and Ms. Aldrich Sevilla-Sacasa, and the orientation meetings were held virtually via videoconference. The Company also endeavors to provide ongoing director education opportunities throughout the year. We intend to periodically hold a Board meeting at one of the Company’s properties in order to increase the Board’s understanding of the Company’s assets, operations and overall business. Our leadership team also presents topics throughout the year to the Board in order to increase directors’ understanding of the Company’s business operations, strategies, risks and opportunities. Directors may enroll in external director continuing education programs at New Senior’s expense on topics relevant to their service on our Board in order to provide a forum for them to maintain their insight into leading governance practices, exchange ideas with peers and keep current their skills and understanding of their duties as directors. Leadership Structure The Company does not have a formal policy to separate the roles of Chief Executive Officer and Chair of the Board of Directors. The Board believes that this is a matter that should be discussed and determined by the Board from time to time and that each of the possible leadership structures for a board of directors has its particular pros and cons, which must be considered in the context of the specific circumstances, giving due consideration to the individuals involved, the culture and performance of the Company, the needs of the business, fulfillment of the duties of the Board and the best interests of the shareholders. Although the Board may determine to combine the roles in the future, since the Company’s spin-off in 2014 the Board has determined that having separate individuals hold the Chair and Chief Executive Officer positions is the right leadership structure for the Board. Mr. Savage, one of our independent directors, has served as the Chair of the Board of Directors since January 2019. Our current Chief Executive Officer, Ms. Givens, also serves as a director, a structure that permits her to focus on the management of the Company’s day-to-day operations while still fostering communication between the Company’s management and the Board of Directors. This structure allows our independent Chair to focus on leading the Board in its responsibilities. As part of these responsibilities, the Chair presides over the Board’s executive sessions. For additional information, see “Executive Sessions of Non-Management Directors.” Shareholder Engagement We value the views of our shareholders and other stakeholders, and the input that we receive from them is a key input to our corporate governance, executive compensation and sustainability practices. Our engagement program is management led and overseen by the Board. Management launched its first formal engagement program in 2019. Management again reached out to shareholders in 2020, contacting shareholders representing over 34% of the Company’s outstanding shares and offering the time to discuss various topics and to hear shareholder concerns. Our discussions with shareholders cover a wide range of topics, including financial and operating performance, strategy, capital allocation, corporate governance, executive compensation, social, environmental and other issues. We believe that it is important for the Board and management to understand shareholders’ views and concerns so that we are better able to address issues that matter to our shareholders and to seek input in order to provide perspective on Company policies and practices. We gain valuable feedback from this type of engagement and the feedback is shared with the Board and its relevant committees. Our discussions with shareholders and with ISS in 2019 and 2020 included hearing their views and concerns and describing the extensive steps the Company has taken to bring its governance practices more in line with shareholder expectations (see above, “Corporate Governance and Related Matters”) and the significantly improved executive compensation and other disclosures in the Company’s proxy statements. In addition, we were encouraged by the investors that we engaged with to publish a report to outline our progress and initiatives with respect to sustainability, and we recently issued our inaugural Sustainability Report to provide transparency and accountability in this important area. | NEW SENIOR INVESTMENT GROUP INC. • 2021 Proxy Statement | 11 |

We encourage our shareholders to continue to engage with us and let us know your feelings about New Senior or to bring any matters to our attention that you would like to discuss. We encourage our registered shareholders to use the space provided on the proxy card unless it is properly revoked prior thereto.to let us know your thoughts about New Senior or to bring a particular matter to our attention. If no specification is made onyou hold shares through an intermediary or received the proxy card asmaterials electronically, please feel free to any one or more of the proposals, the shares of Common Stock represented by the proxy will be voted as follows: | (i) | FOR the election of the Class II nominees to our Board of Directors;

|

| (ii) | FOR the approval of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2019;

|

| (iii) | FOR the approval of amendments to our Certificate of Incorporation and Bylaws to provide for the annual election of all directors;

|

| (iv) | FOR the approval of amendments to our Certificate of Incorporation and Bylaws to eliminate certain provisions that are no longer applicable;

|

| (v) | FOR the approval of amendment to our Bylaws to implement a majority voting standard for uncontested elections of directors; and

|

| (vi) | in the discretion of the proxy holder on any other business that properly comes before the Annual Meeting or any adjournment or postponement thereof.

|

As of the date of this Proxy Statement, we are not aware of any other matterwrite directly to be raised at the Annual Meeting.

Voting

Stockholders of Record. If you are a stockholder of record, you may instruct the proxies to vote your shares by telephone, by the Internet or by signing, dating and mailing the proxy card in the postage-paid envelope provided. In addition, you may vote your shares of our Common Stock in person at the Annual Meeting.

Street Name Holders. If you are a street name holder, you will receive instructions from your bank or broker that you must follow to be able to attend the Annual Meeting or to have your shares voted at the Annual Meeting.

Right to Revoke Proxy

Stockholders of Record. If you are a stockholder of record, you may revoke your proxy instructions through any of the following methods:

send written notice of revocation, prior to the Annual Meeting, to our Secretaryus at New Senior Investment Group Inc., 55 West 46th Street, Suite 2204, New York, New York 10036;

sign, date and mail a new proxy card to our Secretary;

dial the number provided on the proxy card and vote again;

log onto the Internet site provided on the proxy card and vote again; or

attend the Annual Meeting and vote your shares in person.

Street Name Holders. If you are a street name holder, you must contact your bank or broker to receive instructions as to how you may revoke your proxy instructions.

Copies of Annual Report to Stockholders

A copy of our Annual Report on Form10-K for our most recently completed fiscal year has been filed with the Securities and Exchange Commission (the “SEC”) will be mailed to stockholders entitled to vote at the Annual Meeting who have elected to receive a hard copy of the proxy materials and is also available without charge to stockholders upon written request to: New Senior Investment Group Inc., 55 West 46th46 Street, Suite 2204, New York, New York 10036, Attention: Investor Relations. You can

Board and Committee Meetings and Membership The Board of Directors and its committees meet throughout the year on a set schedule, and also findhold special meetings and act by written consent from time to time as appropriate. Under the Guidelines, directors are expected to regularly attend meetings of the Board and the committees of which they are members. Members may attend in person or by telephone. The Board of Directors held 8 meetings during the 2020 fiscal year and there were 16 meetings of standing committees. All directors attended at least 75% of the aggregate of all meetings of the Board and standing committees on which they served. Although director attendance at the Company’s annual meeting each year is encouraged, the Company does not have an electronic versionattendance policy. Ms. Givens and Mr. Savage attended the 2020 annual meeting. The Board of Directors has three standing committees: the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. The Board also formed an Investment Committee during 2020. The following table summarizes the current membership of each Committee: | Director | Independent | Audit | Compensation | Governance | Investment | | Robert F. Savage |  | |  |  |  | | Frances Aldrich Sevilla-Sacasa* |  |  | | | | | Virgis W. Colbert |  |  | | | | | Susan Givens | | | | |  | | Norman K. Jenkins* |  |  | | | | | Michael D. Malone |  |  |  | | | | Stuart A. McFarland |  |  |  | | | | David H. Milner |  | | |  |  | | Cassia van der Hoof Holstein |  | |  |  | | | Number of Meetings in 2020 | | 5 | 7 | 4 | 2 |

| Chair | | * | Mr. Jenkins joined the Board on November 23, 2020 and Ms. Aldrich Sevilla-Sacasa joined the Board on January 25, 2021. |

Board and Committee Roles in Oversight of Risk The Company’s risk management is overseen by the Chief Executive Officer, who receives reports directly from other officers and individuals who perform services for the Company. Material risks are identified and prioritized by management, and material risks are periodically discussed with the Board of Directors. The Board of Directors regularly reviews information regarding the Company’s credit, liquidity and operations, including risks and contingencies associated with each area. In addition to the formal compliance program, the Board of Directors encourages management to promote a corporate culture that incorporates risk management into the Company’s corporate strategy and day-to-day business operations. As part of the Board’s oversight and risk management responsibilities, the Board monitors management’s efforts to identify, prioritize and manage potentially significant risks to our operations. The Board receives regular reports from management regarding material risks to the Company’s business. Throughout 2020, with various rapidly evolving risks presented by the COVID-19 pandemic, the Board received regular updates from management through telephonic and videoconference meetings of the Board, and various other communications between regularly scheduled Board meetings. These reports and updates addressed a host of areas, including measures that we and others are considering or have adopted to address the transmission of COVID-19, the financial impacts of the pandemic, appropriate communications with stakeholders, business continuity and the safety of the Company’s employees and other matters. | NEW SENIOR INVESTMENT GROUP INC. • 2021 Proxy Statement | 12 |

The various Board committees also participate in oversight of the Company’s risk management efforts and report to the full Board for consideration and action when appropriate, as summarized in the table below. | Committee | | Primary Areas of Risk Oversight | | Audit Committee | | Oversees New Senior’s policies on risk assessment and management, and oversees risks related to the Company’s financial statements, the financial reporting process, accounting matters, and other areas of significant financial risk. Also oversees information security matters and risks, and assesses risks related to legal and regulatory matters that may have a material impact on the Company’s financial statements. | | Compensation Committee | | Oversees compensation-related risks and management succession planning risks. For additional information regarding the Compensation Committee’s role in evaluating the impact of risk on executive compensation, see page 40 of Compensation Discussion and Analysis. | | Nominating and Corporate Governance Committee | | Evaluates risks in connection with the Company’s corporate governance structures and processes and risks related to other primarily nonfinancial matters. | | Investment Committee | | Oversees risks with respect to New Senior’s investment and financing practices and strategies. |

Overview of Standing Committees The charters of each of the three standing committees of the Board (Audit, Compensation and Nominating and Corporate Governance) conform with applicable NYSE listing standards, and each of these committees reviews its charter at least annually, and as regulatory developments and business circumstances warrant. Each of the committees considers revisions to their respective charters from time to time to reflect evolving best practices. The descriptions below of the roles and responsibilities of each of the committees of the Board is qualified by reference to the complete committee charters, which are available on our website at www.newseniorinv.com. Audit Committee | Attendance | | Responsibilities | Meetings Held in 2020: 5 Committee Members Stuart A. McFarland (Chair)

Frances Aldrich Sevilla-Sacasa (appointed January 25, 2021)

Virgis W. Colbert

Norman K. Jenkins (appointed November 23, 2020)

Michael D. Malone | | Purpose: to assist the Board of Directors in fulfilling its legal and fiduciary obligations with respect to matters involving the accounting, auditing, financial reporting, internal control and legal compliance functions of the Company and its subsidiaries. The Audit Committee is primarily responsible for assisting the board’s oversight of: • the integrity of the Company’s financial statements; • the Company’s compliance with legal and regulatory requirements; • the Company’s independent registered public accounting firm, including determining the firm’s qualifications, independence, scope of responsibility and compensation; • the performance of the Company’s independent registered public accounting firm and the Company’s internal audit function; and • overseeing the Company’s policies on risk assessment and management. The Audit Committee has also been charged by the Board with overseeing our information security and technology risks. | | Audit Committee Report Page 26 | | |

The Audit Committee has established policies and procedures for the pre-approval of all services by our independent registered public accounting firm. The Audit Committee also has established procedures for the receipt, retention and treatment, on a confidential basis, of complaints received regarding accounting, internal controls and auditing matters. Additional details on the role of the Audit Committee may be found in “Proposal No. 2, Ratification of the Appointment of Ernst & Young LLP as Independent Registered Public Accounting Firm” later in this Proxy Statement. The Board of Directors has determined that each member of the Audit Committee is financially literate and independent, as defined by the Securities and Exchange Commission (the “SEC”) rules and the NYSE’s listing standards, as well as independent under the Guidelines. The Board of Directors has identified Mr. McFarland as | NEW SENIOR INVESTMENT GROUP INC. • 2021 Proxy Statement | 13 |

an “Audit Committee Financial Expert” as defined by SEC rules and has determined that he has the accounting and related financial management expertise required by the NYSE’s listing standards. The Board of Directors has also determined that Mr. McFarland’s simultaneous service on the audit committees of Brookfield Investment Funds, Inc., New America High Income Fund, Inc. and Drive Shack Inc. would not impair his ability to effectively serve on our Audit Committee, as evidenced by his exemplary attendance record at committee meetings and his meaningful contributions to the committee’s operations. The Board of Directors has evaluated the performance of the Audit Committee consistent with regulatory requirements. One of the most recent additions to the Audit Committee’s responsibilities is formal oversight over the Company’s information security and technology risks. Management intends to provide a report annually to the Board, through the Audit Committee, on matters related to information security risks. Currently on New Senior’s Board there are eight directors with information security experience. As of the date of this Proxy Statement, New Senior has not experienced an information security breach over the last three years and has not incurred any expenses relating to breaches. New Senior is a small employer and does not have an internal information technology (“IT”) department or staff. New Senior’s IT systems are hosted by a third-party provider, which is subject to external audits and certified by industry-accepted information security standards. New Senior’s third-party provider also provides periodic training to New Senior employees, and its own employees and contractors who work on New Senior’s matters, relating to various subjects, including identifying and understanding cyber-attacks, phishing and ransomware. Compensation Committee | Attendance | | Responsibilities | Meetings Held in 2020: 7 Committee Members Michael D. Malone (Chair)

Stuart A. McFarland

Robert F. Savage

Cassia van der Hoof Holstein | | Purpose: to provide oversight of the compensation and benefits provided to employees of the Company. The Compensation Committee reviews and approves the Company’s overall compensation philosophy and oversees the administration of the Company’s executive compensation and benefit programs, policies and practices. Its responsibilities also include: • establishing annual performance objectives, evaluating performance and approving individual compensation actions for the Chief Executive Officer and other executive officers; • approving the Compensation Discussion and Analysis included in the Company’s annual proxy statement; • reviewing and approving the Company’s peer companies and data sources for purposes of evaluating our compensation competitiveness and the mix of compensation; • making recommendations to the Board regarding non-management director compensation; and • leading the Company’s chief executive officer succession process. | | Compensation Committee Report Page 48 | | |

The Board of Directors has determined that each member of the Compensation Committee is independent, as defined by SEC rules and the NYSE’s listing standards, as well as independent under the Guidelines. In addition, each committee member is a “non-employee director” as defined in Rule 16b-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Board of Directors has evaluated the performance of the Compensation Committee consistent with regulatory requirements. As stated above, in addition to its responsibilities related to executive compensation, the Compensation Committee also evaluates the compensation program for the non-management directors and makes recommendations to the Board regarding their compensation. The Compensation Committee has retained FPL Associates (“FPL”) as its independent consultant for this purpose. FPL’s responsibilities include providing market comparison data on non-management director compensation at peer companies, tracking trends in non-management director compensation practices, and advising the Compensation Committee regarding the components and levels of non-management director compensation. Executive officers do not play any role in either determining or recommending non-management director compensation. The Compensation Committee reviewed director compensation in 2020 after the onset of the COVID-19 pandemic and determined to amend the compensation program to require that all payments of director compensation scheduled to be made in 2020 be paid in equity, rather than any in the form of cash (see “2020 Non-Management Director Compensation—Compensation of Directors” for a discussion of the changes to the director compensation program). The Compensation Committee is not aware of any conflict of interest on the part of FPL arising from these services or any other factor that would impair FPL’s independence. None of the members of the Compensation Committee during 2020 or as of the date of this Proxy Statement have been an officer or employee of the Company and no executive officer of the Company served on the compensation committee or board of any company that employed any member of our Annual Report on the Investor Relations sectionCompensation Committee or Board of Directors. | NEW SENIOR INVESTMENT GROUP INC. • 2021 Proxy Statement | 14 |

Nominating and Corporate Governance Committee | Attendance | | Responsibilities | Meetings Held in 2020: 4 Committee Members David H. Milner (Chair)

Robert F. Savage Cassia van der Hoof Holstein | | Purpose: to ensure that the Board of Directors is appropriately constituted to meet its fiduciary obligations to shareholders of the Company. The Nominating and Corporate Governance Committee oversees the practices, policies and procedures of the Board and its committees. Responsibilities include: • evaluating the size, composition, governance and structure of the Board and the qualifications, compensation and retirement age of directors; • identifying, evaluating and proposing nominees for election to the Board; and • considering the independence and possible conflicts of interest of directors and executive officers and ensuring compliance with applicable laws and NYSE listing standards. This committee is directly responsible for: • overseeing the self-evaluations of the Board and its committees; • reviewing our Corporate Governance Principles; • overseeing and reviewing potential transactions, as directed by the Board, under the Company’s Related Party Transactions Policy; and • maintaining an informed status regarding the Company’s sustainability initiatives and engagement. |

The Board of Directors has determined that each member of the New Senior website (www.newseniorinv.com).Nominating and Corporate Governance Committee is independent, as defined by SEC rules and the NYSE’s listing standards, as well as independent under the Guidelines. The Board of Directors has evaluated the performance of the Nominating and Corporate Governance Committee consistent with regulatory requirements. Voting ResultsExecutive Sessions of Directors

Broadridge Financial Solutions, Inc., our independent tabulating agent, will count the votes and act as the Inspector of Election. We will publish the voting results in a Current Report on Form8-K, which will be filed with the SEC within four business days of the Annual Meeting.

Confidentiality of Voting

We keep all proxies, ballots and voting tabulations confidential as a matter of practice. We permit only our Inspector of Election, Broadridge Financial Solutions, Inc., to examine these documents.

RecommendationsAgendas for meetings of the Board of Directors include regularly scheduled executive sessions led by the Board’s non-executive Chair for the independent directors to meet without management present. In addition, Board members have access to our employees outside of Board meetings, and the Board encourages directors to visit different Company properties whenever possible, either as part of a regularly scheduled Board meeting or otherwise.

Director Independence The Board of Directors, recommendsthrough the Nominating and Corporate Governance Committee, conducts an annual review of the independence of its members. With the assistance of legal counsel to the Company, the Nominating and Corporate Governance Committee has reviewed the applicable standards for Board and committee member independence, as well as the standards established by the Guidelines. On the basis of its review, the Nominating and Corporate Governance Committee has delivered a vote:report to the full Board of Directors, and the Board has made its independence determinations based upon the committee’s report and the supporting information. The Board has determined that all of the current directors, other than Ms. Givens, due to her position as Chief Executive Officer, satisfy the independence standards of NYSE and do not have any direct or indirect material relationship with the Company. In addition, the Board has determined that the current members of the Audit Committee and of the Compensation Committee meet the applicable SEC and NYSE listing standard independence requirements with respect to membership on such committees. Code of Business Conduct and Ethics The Board of Directors has adopted a Code of Business Conduct and Ethics that applies to each of our directors and officers, including our principal executive officer and principal financial officer, as well as all other employees. The purpose of the Code of Business Conduct and Ethics is to promote, among other things, honest and ethical conduct, full, fair, accurate, timely and understandable disclosure in public communications and reports and documents that the Company files with, or submits to, the SEC, compliance with applicable governmental laws, rules and regulations, accountability for adherence to the code and the reporting of violations thereof. | NEW SENIOR INVESTMENT GROUP INC. • 2021 Proxy Statement | 15 |

The Company also has adopted a Code of Ethics for Senior Officers which sets forth specific policies to guide the Company’s Chief Executive Officer, Chief Financial Officer and Chief Accounting Officer (or persons performing similar functions in the absence of such titles) in the performance of their duties. This code supplements the Code of Business Conduct and Ethics described above. The Code of Business Conduct and Ethics and Code of Ethics for Senior Officers are available on our website at www.newseniorinv.com. The Company intends to disclose any changes in or waivers from either code applicable to the Company’s executive officers or directors by posting such information on our website. The Company has established a confidential ethics phone line and email address to respond to employees’ questions and reports of ethical concerns. Also, the Audit Committee has established a policy with procedures to receive, retain and treat complaints received by the Company regarding accounting, internal controls or auditing matters, and to allow for the confidential, anonymous submission by employees of concerns regarding accounting or auditing matters. Communication with the Board of Directors The Company encourages shareholders and other interested parties to communicate with our directors. You can contact our Board of Directors to provide comments, to report concerns, or to ask a question, at the following address: New Senior Investment Group Inc. Corporate Secretary 55 West 46 Street, Suite 2204 New York, New York 10036 Shareholders may contact any of our directors (including the non-executive Chair), a committee of the Board, the Board’s non-management directors as a group, or the Board as a whole, at the address above or at the following email address: ir@newseniorinv.com. All communications received that are not in the nature of advertising, promotions of a product or service or patently offensive material will be forwarded promptly to the addressee. Junk mail, advertisements, product inquiries or complaints, resumes, spam and surveys are not forwarded to the Board. In the case of communications to the Board or any group or committee of directors, sufficient copies of the contents will be made for each director who is a member of the group or committee to which the envelope or e-mail is addressed. Concerns relating to accounting, internal controls or auditing matters are brought to the attention of the Chair of the Audit Committee and handled in accordance with procedures established by the Audit Committee with respect to such matters. Certain Relationships and Related Party Transactions Review of Transactions with Related Persons SEC rules define “transactions with related persons” to include any transaction in which the Company is a participant, the amount involved exceeds $120,000, and in which any “related person” has a direct or indirect material interest. A “related person” includes an executive officer, director or nominee for director of the Company, a beneficial owner of more than 5% of any class of our voting securities or an immediate family member of any of the foregoing. The Company has adopted a written Related Party Transactions Policy, which outlines procedures for approving transactions with related persons. The Nominating and Corporate Governance Committee reviews and approves or ratifies such transactions pursuant to the procedures outlined in this policy. In determining whether to approve or ratify a transaction with a related person, the Nominating and Corporate Governance Committee will take into account, among other factors, whether the transaction is on terms no less favorable than terms generally available to an unaffiliated third party under the same or similar circumstances and the extent of the related person’s interest in the transaction. The policy provides standing pre-approval for certain types of transactions that the Nominating and Corporate Governance Committee has reviewed and determined shall be deemed pre-approved. Certain Relationships and Transactions with Related Persons No reportable transactions with related persons have occurred during 2020 or are currently proposed. History of New Senior Until January 1, 2019, we were externally managed and advised by an affiliate of Fortress Investment Group LLC (the “Former Manager”). On November 19, 2018, we entered into definitive agreements with the Former Manager to internalize our management, effective January 1, 2019. Prior to the Internalization, we did not have any employees, and the individuals who provided services to us were employed by the Former Manager at the time. In connection with the Internalization, we hired 16 employees previously employed by the Former Manager, including certain of our executive officers. In connection with the Internalization, we also entered into a transition services agreement (which has now expired) with the Former Manager to continue to provide certain services for a transition period. | NEW SENIOR INVESTMENT GROUP INC. • 2021 Proxy Statement | 16 |

Corporate Responsibility and Sustainability The Board understands that sustainability is a key focus for today’s investors and takes investor feedback on sustainability seriously. We believe that corporate responsibility and sustainability play an important role in our business and operating strategies and long-term value creation for our shareholders, customers and employees. Our Nominating and Corporate Governance Committee of the Board has responsibility for oversight of our sustainability-related practices and will be monitoring our progress in this area. We also utilized our engagement discussions with investors as an opportunity to better understand our shareholders’ priorities and expectations regarding environmental, social, and governance factors. In light of the feedback that we received, we are evaluating the most material risks to the Company and endeavoring to create opportunities to enhance our bottom line and sustain long-term financial value. We also were encouraged by the investors that we engaged with to publish a report to outline our progress and initiatives to date, and we recently issued our inaugural Sustainability Report to provide transparency and accountability in this important area. We continue to evaluate our overall approach to non-financial reporting, including adherence to one or more of the several existing, globally recognized external frameworks. Given that we are a real estate business, to date we have been focused on a few key areas of sustainability, namely: | Environmental Sustainability | We provide capital to our operators to implement and explore innovative ways to optimize efficiency and reduce our energy, water and waste footprint: • Utilize energy management system • LED retrofits • High-efficiency HVAC and PTAC systems and appliances • Occupancy sensors • Xeriscaping and smart irrigation systems • High-efficiency water fixtures and aerators • Partnering with vendors focused on sustainability • Recycling program in corporate office | | Social Responsibility | We support our home office employee efforts and development by providing them with an inclusive and diverse culture: • Focused on providing a positive and engaging work environment for our employees and building a healthy and high performing culture • Competitive benefits program including comprehensive healthcare, 401(k) plan with a Company contribution; bonus and incentive pay opportunities; competitive paid-time off benefits; paid parental leave; wellness programs and development opportunities • Equal opportunity employer •Ensure Fair Labor practices • Encourage volunteerism through dedicated paid time off to employees to volunteer in their communities; Company matching gift program • 56% of Board of Directors (5/9) is diverse • 100% of Leadership Team (3/3) is diverse We make corporate contributions to charitable organizations which are aligned with our values and purpose. We made substantial corporate donations in 2020 to: • Holiday Retirement’s Better Together Foundation – an employee assistance foundation with the mission of providing charitable assistance to Holiday employees (who are the employees of our largest operator) • NAACP Legal Defense Fund • Sponsors for Educational Opportunities We partner with operators focused on providing their employees and residents a safe and energizing environment: • Holiday Retirement (our largest operator) achieved the “Great Place to Work” National Certification and was named by Fortune as one of the Best Workplaces for Aging Services | | Governance | We seek to maintain practices which provide the right governance framework while being open and responsive to shareholder input: • Board composition shows commitment to diversity (3 women and 3 racially/ethnically diverse directors) • Board has demonstrated its commitment to evolving its governance processes, as indicated above in “—Governance Overview” •Comprehensive code of ethical legal and business conduct applicable to the Board and all employees |

| NEW SENIOR INVESTMENT GROUP INC. • 2021 Proxy Statement | 17 |

2020 Non-Management Director Compensation Compensation of Directors Under our 2019-2020 director compensation program, the annual retainer payable to each non-employee member of the Board was $150,000. The program provides for $50,000 of the annual retainer to be paid in cash, and $100,000 of the annual retainer be paid in RSUs.

Additional compensation for non-employee directors who are chairpersons of each of the committees of the Board, and the non-Executive Chair of the Board, is as follows and is payable in cash: | | (i)Chair Annual Retainer | FOR the electionChair of the nominees to our Board of Directors;

| $ 25,000 | | Audit Committee | 15,000 | | Compensation Committee | 10,000 | | Nominating and Corporate Governance Committee | 10,000 | | Investment Committee | N/A |

Shortly after the onset of the COVID-19 pandemic in 2020, the Compensation Committee re-evaluated the director compensation program and determined to forego all cash payments in 2020 and instead to receive all non-employee director compensation that was due to be paid in 2020 (which includes some service for the 2019-2020 director term and some service for the 2020-2021 director term) instead in the form of equity grants. For ease of administration and to reflect as closely as possible the nature of the applicable compensation, some payments to directors in 2020 were made in the form of fully vested shares of Common Stock, and some payments were made in the form of RSUs. The $100,000 RSU portion of the annual retainer which was granted to our non-employee directors in June 2020 is subject to vesting on the business day immediately prior to the first regularly scheduled annual meeting of our shareholders occurring after the date of grant, subject to the director’s continued service through the vesting date. The cash amounts payable to our non-employee directors are paid semi-annually in arrears on June 15 and December 15 of each year. Ms. Givens is not separately compensated by us for her service as a member of the Board. All members of the Board are reimbursed for reasonable costs and expenses incurred in attending meetings of our Board. Director Compensation Table for 2020 | Name | Fees Earned or

Paid in Cash(1) | Stock Awards(2)(3) | Total | | Robert F. Savage | $ 0 | $ 175,000 | $ 175,000 | | Virgis W. Colbert | 0 | 150,000 | 150,000 | | Norman K. Jenkins | 0 | 65,104 | 65,104 | | Michael D. Malone | 0 | 160,000 | 160,000 | | Stuart A. McFarland | 0 | 165,000 | 165,000 | | David H. Milner | 0 | 160,000 | 160,000 | | Cassia van der Hoof Holstein | 0 | 150,000 | 150,000 |

| (1) | (ii)Represents all fees earned in cash under our director compensation program. | | (2) | FORThe amounts reported in this column include the approvalaggregate grant date fair value of each RSU award granted in 2020 calculated in accordance with FASB ASC Topic 718. The fair value of these awards was determined using the Company’s stock price as of the appointmentdate of Ernst & Young LLPgrant as independent registered public accounting firmnoted in Note 15, Stock-Based Compensation, to our Consolidated Financial Statements included in our Annual Report on Form 10-K for the Company for fiscal year 2019;

ended December 31, 2020. | | (3) | As of December 31, 2020, each of our non-employee directors other than Mr. Jenkins held 5,000 fully vested options to acquire shares of our Common Stock. |

| (iii) | FOR the approval of amendments to our Certificate of Incorporation and Bylaws to provide for the annual election of all directors;

Frances Aldrich Sevilla-Sacasa was elected to the Board on January 25, 2021 and therefore did not earn compensation as a director in 2020. |

| NEW SENIOR INVESTMENT GROUP INC. • 2021 Proxy Statement | (iv) | FOR the approval of amendments to our Certificate of Incorporation and Bylaws to eliminate certain provisions that are no longer applicable; and

18 |

Non-Management Director Stock Ownership Guidelines New Senior’s stock ownership guidelines currently provide for non-management directors to achieve stock ownership levels of four times the annual base cash retainer amount within five years of joining the Board or adoption of the guidelines. As indicated above in “2020 Non-Management Director Compensation,” non-management directors receive a portion of their retainer in RSUs, which are paid in New Senior shares when the RSUs vest. Non-management directors are required to hold such shares until their total share ownership meets or exceeds the ownership guidelines. Both the guidelines, and compliance with the guidelines, are monitored periodically. All non-management directors with at least one full year of service on the Board of Directors own stock in the Company. Directors are also subject to the Company’s policy prohibiting hedging and speculative trading in the Company’s securities, including short sales and leverage transactions, such as puts, calls, and listed and unlisted options. All non-management directors either currently meet the guidelines or are on track to meet the guidelines within five years of joining the Board or adoption of the guidelines. Indemnification and Insurance As permitted by its Bylaws, New Senior indemnifies its directors to the fullest extent permitted by law and maintains insurance to protect the directors from liabilities, including certain instances where New Senior could not otherwise indemnify them. | NEW SENIOR INVESTMENT GROUP INC. • 2021 Proxy Statement | (v) | FOR the approval of amendment to our Bylaws to implement a majority voting standard for uncontested elections of directors.

19 |

PROPOSAL NO.Proposal 1

ELECTION OF DIRECTORSElection of Directors

The first proposal is to elect threetwo Class III directors to serve until the 20222024 annual meeting of stockholdersshareholders and until their respective successors are duly elected and qualified. Our Certificate of Incorporation authorizes the number of directors to be not less than one, nor more than fifteen.

The number of directors on the boardBoard is currently fixed at seven.nine. Our Board of Directors is divided into three classes. The members of each class of directors serve staggered three-year terms. Our current Board of Directors is classified as follows: | | | | | | | Class | | Term Expiration | | Director | | Age | | Class I | | 2021 | | Virgis W. Colbert | | 79 | | | | | Cassia van der Hoof Holstein | | 43 | | Class II | | 2019 | | Susan Givens | | 42 | | | | | Michael D. Malone | | 65 | | | | | David H. Milner | | 51 | | Class III | | 2020 | | Stuart A. McFarland | | 72 | | | | | Robert Savage | | 51 |

| Class | Term Expiration | Director | | Class I | 2021 | Norman K. Jenkins

Cassia van der Hoof Holstein

Virgis W. Colbert | | Class II | 2022 | Susan Givens

Michael D. Malone

David H. Milner | | Class III | 2023 | Frances Aldrich Sevilla-Sacasa

Stuart A. McFarland

Robert F. Savage |